The Monetary Power Struggle

Crypto VS Banks VS the State

We live in exciting times. Private banks' privilege to create money is challenged by new innovative types of digital money. Who will win the competition: the nation-state, private banks, or new financial companies issuing cryptocurrencies? What is really at stake here, and what can you do to make sure democracy wins over private profit interests?

To help you understand this power struggle, we have invited professor Joseph Huber who has just released a brand new book on the topic. Watch the webinar now with professor Joseph Huber, download his slides and read Huber's answers to questions in the chat:

*By clicking the button, you agree that Positiva Pengar will email you more information about coming webinars. You can stop receiving our emails whenever you want by clicking unsubscribe in our email.

Who should create our money?

The monetary system is at a turning point. The hitherto dominant type of money, bank money (deposit created by private banks), has past its zenith. New types of digital money are on the rise, competing for becoming the next dominant type of money. The new type of digital token monies include Central Bank Digital Currency (CBDC) and unbacked as well as covered cryptocurrencies, so-called stablecoins. Different actors are competing to take advantage of the new technology and become the monetary power of the new century. Who is likely to win and who do we want to become the creator of money in the future and enjoy the benefits from this?

Private banks?

Today, private banks create most of our money. New money is spent on things that make the banks more profitable, not for the benefit of society and citizens. The result is massive inflation on the stock market and the real estate market - prices increase so the owners of capital get even richer. If the banks go bankrupt, all the money disappears and society stagnates in an acute shortage of money. This is why the government has to bail out banks when they get into trouble.

Crypto corporations?

Today, multinational tech companies and decentralized anarchistic tech communities plan to challenge the traditional banking sector with the help of new technological innovations for creating money and managing payments. If a multinational company such as Google or Meta succeeds, it may take over the world's payment markets fast and gain huge amount of power and detailed knowledge over our shopping habits.

The democratic State?

An alternative is for a democratic unit to use the new technology to create our digital money, for example a Central Bank Digital Currency (CBDC) or Treasury Direct Digital Currency (TDDC). This means money will become a safe asset that not will disappear in the case of bankruptcy. Then, we don't have to bail out the banks, they can go bankrupt without society stagnating in an acute shortage of money. The state can create new money for the benefit of everyone instead of for the benefit of a few.

Historical monetary power struggles

Throughout history, there has been a struggle over who should have the power to create money, put others into debt and thus control what others do and the direction in which society develops. In his new book (available in German and in English), Joseph Huber identifies three turning points in the modern history of money. Right now, we are in the beginning of a fourth turning point.

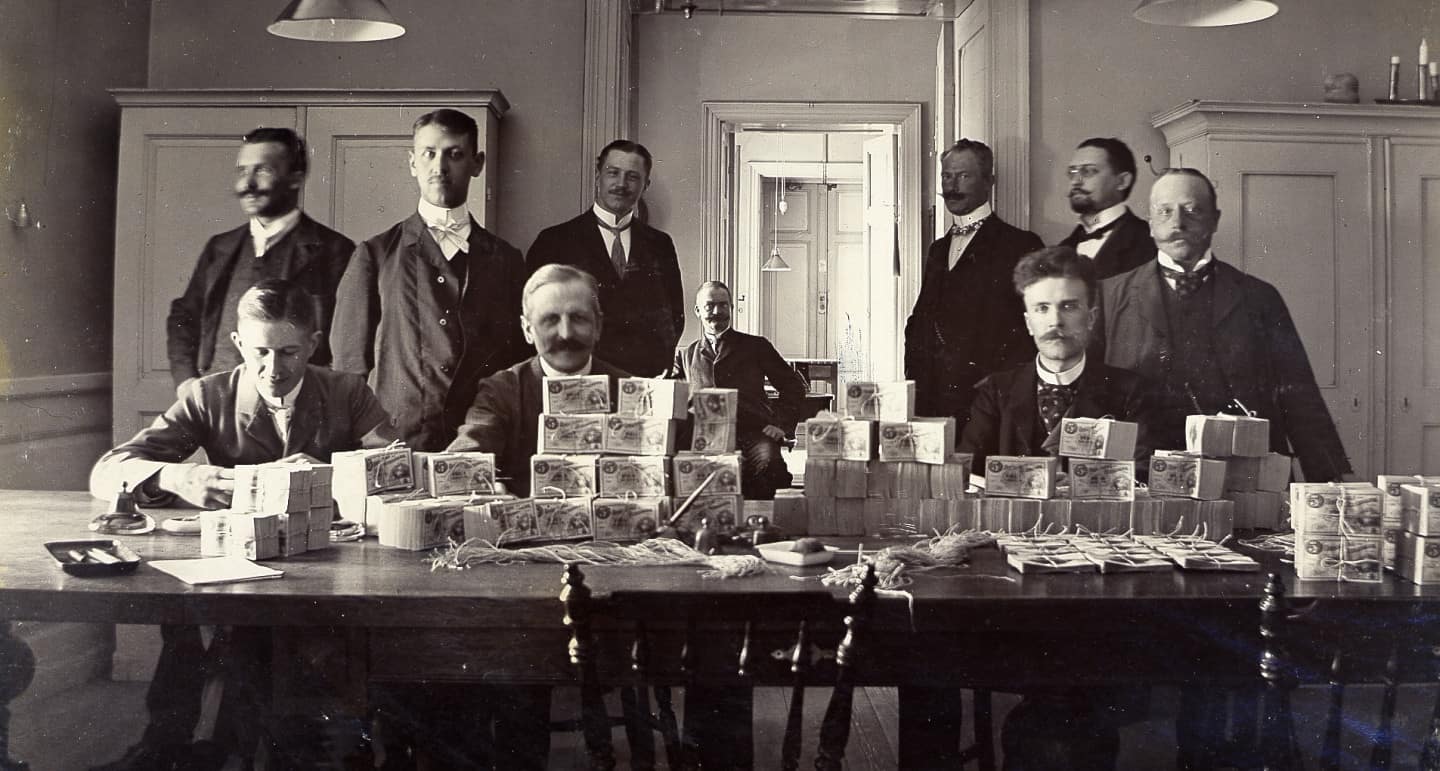

1. Private banknotes

Historically, most money was sovereign coins issued by the state made of silver, copper and gold. However, there was too little coinage to meet the needs of growing populations and economies. The innovation of the printing press enabled a new, more flexible type of paper money. Between 1660s and 1840s the old coins lost the competition with the paper money issued by private companies.

2. State banknotes

The growing amount of unregulated private banknotes gave rise to many problems: over-issuance of money, bank-runs, financial crises, debt and asset bubbles etc. Between 1840-1910, all European countries gradually introduced the banknote monopoly of the central banks, based on a gold-standard to put an artificial limit to the money supply.

3. The bank money regime

The gold standard was not consistently successful. The limited supply of gold could not handle the growth pressure resulting from industrialization and urbanization. Hence, the private banks established cashless payments with "check book money", hereafter called "bank money", which managed to operate upon an increasingly smaller gold base. The competition between bank money and notes issued by the state occurred between 1910 and 2010 and was accelerated by digital technology that enabled instant payments without the need to visit a bank office physically.

4. The new era of digital token money

The bank money regime led to recurrent over-issue of money, credit and debt crises. The effectiveness of monetary policy diminished and money creation largely went out of control. Moreover, the bank money regime was developed to make efficient use of a limited gold base, not to handle globalized and fast payments in a digital world. To make a payment today, there often are up to 9 different private companies involved that need to communicate. The process costs 1-3% for national payments and up to 8% for international payments with processing times of sometimes over a week.

Today, new technological innovations enable a paradigm shift: digital token money can be transferred directly from one e-wallet to another, completely independent of private banks as intermediaries. This paradigm shift in how money is created, circulated and distributed makes it possible to take democratic control of the monetary system. Together, we can create a fair, sustainable and democratic monetary system that benefits the majority rather than the few.

Who will win?

Who will win the monetary power struggle: private banks trying to spice up their old bank-money, states with their new digital token money, or private corporations offering cryptocurrencies?

The new form of digital token money is superior to previous forms of money, technologically as well as economically. Digital tokens offer far-reaching potentials in terms of usability, including future programmability. State issued digital tokens are superior to private tokens by virtue of being legal tender and safe-stock base money, and also because of the constitutional need to re-establish monetary sovereignty and effectual monetary policy.

But even if digital money is superior, the old bank money may still persist for a long period of time, especially if the state chose to continue to guarantee and support bank money. This would be analogous to a situation where the horse-and-cart-industry never really dies in competition with cars, because the old industry enjoys heavy government support, special privileges, and subsidies that keep them alive even though their product is totally out of date. This means that there is a substantial risk that banks continue to issue too much money, creating asset-bubbles, financial crises, and economic inequality.

And even if state issued digital tokens are superior to private tokens, private multinational companies issuing their own token-money may still win, especially if nation-states intentionally design CBDCs or TDDCs to be unattractive, introduce caps and restrictions on them, don't use the full potential of the new technology, etc. Then there is a substantial risk that multinational companies win the race through designing their own cryptocurrency that becomes the dominant type of money. This means that the sovereignty of the national state's money and economy would be seriously threatened.

Should we continue as before and give up the state's monetary sovereignty to private banks and multinational companies, or should we take this historical opportunity to get democratic control over our national economies and issue money for the benefit of everyone?

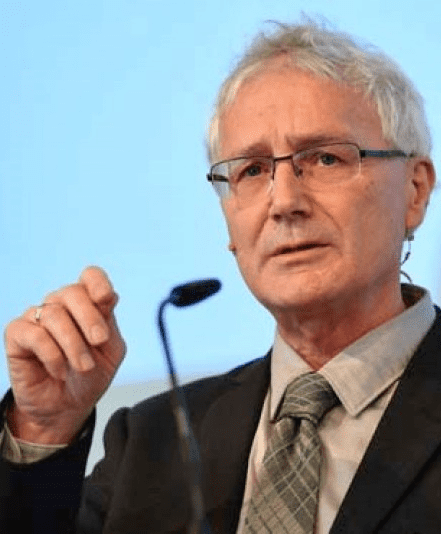

Professor Joseph Huber

Joseph Huber is a leading researcher in monetary and banking theory, and Professor emeritus of economic and ecological sociology at Martin Luther University of Halle-Wittenberg, Germany. He has made influential contributions to recent monetary system analysis and reform, for instance the book "Sovereign Money. Beyond Reserve Banking" (2017) and his brand new book "The monetary Turning Point: From Bank Money to Central Bank Digital Currency (CBDC)". He is co-founder of the monetary reform initiative Monetative e.V. Berlin.

Joseph Huber is also one of the founders of the theory of ecological modernization (also called ecomodernism) which is a school of thought that seeks to reconcile economic growth with environmental protection.

Check out his blog here https://sovereignmoney.site

Historic opportunity

Central bankers and politicians all around the world are right now investigating the possibilities and risks with new types of digital money. We now have a historic opportunity to influence and ensure that money creation is organized in a fair and sustainable way. Therefore, Positiva Pengar, Alliance For Just Money, Monetative, Gode Peng, ProVollgeld Austria, Forum Geldpolitik and Talousdemokratia, members of the International Movement for Monetary Reform, are organizing courses and webinars on the topic. We are happy to offer this one together. Sign up and feel free to invite friends and acquaintances.

❝

Never doubt that a small group of thoughtful, committed, citizens can change the world. Indeed, it is the only thing that ever has.

Margaret Mead

When? Where? How?

Organizers

IMMR consists of non-profit organizations that focus on the critical issue of our time - the creation and disappearance of money and its consequences for the development of society and our lives.

We are non-partisan and act only for this issue. Our vision is that the money system should be fair, sustainable and democratic and used for the benefit of society as a whole.